We’re facing a climate emergency. We have a very limited timeframe in which to engage massive collective action to lessen the devastating effects of ecological disruption – extreme weather events, endangered urban infrastructure, health challenges, population displacement and food insecurity that will flow from a changing climate. The impacts of climate injustice fall unequally upon the oppressed, discriminated, poor and vulnerable. Students at York are keenly aware of this cloud in our future. But is York University, recipient of our tuition fees, heeding the call?

A group of students and faculty are raising the alarm about York funding the fossil fuel industries that continue to feed the crisis, and the financial institutions that insist on funding climate disruption.

York University holds two major investment funds. The Endowment Fund (worth over $600 million at the end of 2021) builds on philanthropy and some university and government funding. It supports scholarships, academic chairs, research and capital investments. The Pension Fund (worth around $3.0 billion in September 2022), funded both by York’s money (including your tuition!) and contributions from York’s employees, will pay the pensions of these employees.

These are sizable investments, even by Bay Street standards. It matters whether this money is feeding the climate crisis. And unfortunately, it is.

True, most major investment funds in Canada are doing the same – pursuing profits with disregard for their social and ecological impacts. However, that is changing. Student and faculty movements across North America and around the world are challenging universities – institutions claiming to build the future of young people – for taking action, through their investments, that is actually undermining that future.

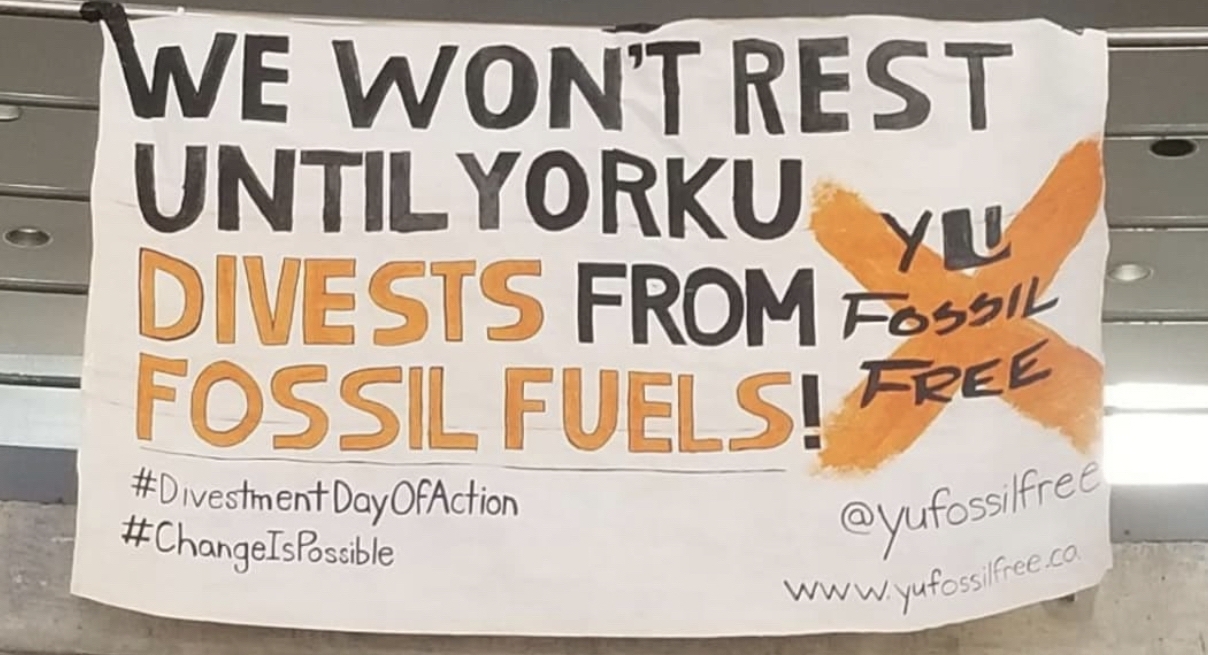

At York, the YU Fossil Free Campaign (YUFF), is calling for divestment from investments in fossil fuel extraction, production and transportation. It is clear that a thriving future and a habitable planet requires a phaseout of climate-disrupting coal, gas and oil. Those assets should be sold off and banned from the investment portfolios. There is no more space in the global “carbon budget” – the total amount of carbon the atmosphere can accept while keeping global warming within acceptable limits – for new fossil fuel infrastructure.

YUFF is also calling on York University to reduce the “carbon footprint” of its investment portfolio. This means reducing the climate impact of the emissions financed through the assets in the portfolio, such as bank shares. To reduce them, preference would be given, for example, to Canadian banks that choose to stop funding the expansion of the oil sands.

To measure the financed emissions, a “carbon audit” or assessment of York’s portfolios is required. The university has performed two audits (in 2016 and 2022), claiming substantial progress, but has kept the methods, data and results secret, eroding confidence in its claims.

York continues to rely on an ESG strategy for its investment portfolio – following indicators linked to environmental, social and governance goals. That sounds good in principle, but it is discredited as an effective approach on climate. There is no evidence that ESG indicators translate into real climate action.

YUFF has presented a number of calls for action, detailed in a letter on the Pension Fund sent to York’s administration and Board of Governors with the endorsement of York’s major unions. Their members contribute to the fund and will be its beneficiaries. YUFF’s letter on the Endowment Fund makes similar points.

We have engaged with York’s leadership on these issues since early 2021. President Lenton and other officials have engaged in a constructive dialogue. In these exchanges and in their communication they have expressed important messages that point in the right direction, However, evidence for action is harder to find.

Other Canadian universities are moving forward and have proudly announced their plans to divest (a summary of that action can be found here). York has said little so far.

In early 2021, York’s vice president of finance informed YUFF that York had reduced its direct holdings of major fossil fuel assets (those in the Carbon Underground 200 list) in the Endowment and Pension Funds to 2% of the equity holdings. We applauded that reduction. But we have had no updates since then on further divestment from fossil fuel assets. York has continued to express disapproval of “divestment” or the idea of negative screening (i.e., banning) of assets in the portfolios.

Given the boom in the oil and gas markets resulting from geopolitical conditions, such as the Ukraine war, we are concerned that York and other universities have actually increased the value of their fossil fuel holdings during the last year. We hope to be wrong, but the lack of transparency of what is in the investment portfolios is troubling.

The lack of accountability and transparency remains a major concern for students, staff and faculty. The reputational damage to York is substantial, given York’s bold claims about sustainability, when other institutions demonstrate real action. YUFF has repeatedly asked to meet with the Board of Governors on these matters, but has yet to receive a positive response .

This is both puzzling and frustrating as York’s university academic plan speaks eloquently about addressing a “moment of unprecedented trial for human and planetary health, security, well-being, and understanding” as being essential to achieving a better future. Certainly, a better future is what York students want and deserve. But is York ready to put its money (our money, really) where its mouth is?

Peri Dworatzek and Amanda Rooney, students in the Master of Environmental Studies, and Ricardo Grinspun, a faculty member in the Department of Economics, are members of the YUFF steering committee.

YUFF invites members of the York community – students, staff and faculty – to join our work. You can contact us at yufossilfree@gmail.com. Check our website here, and sign our petition here.