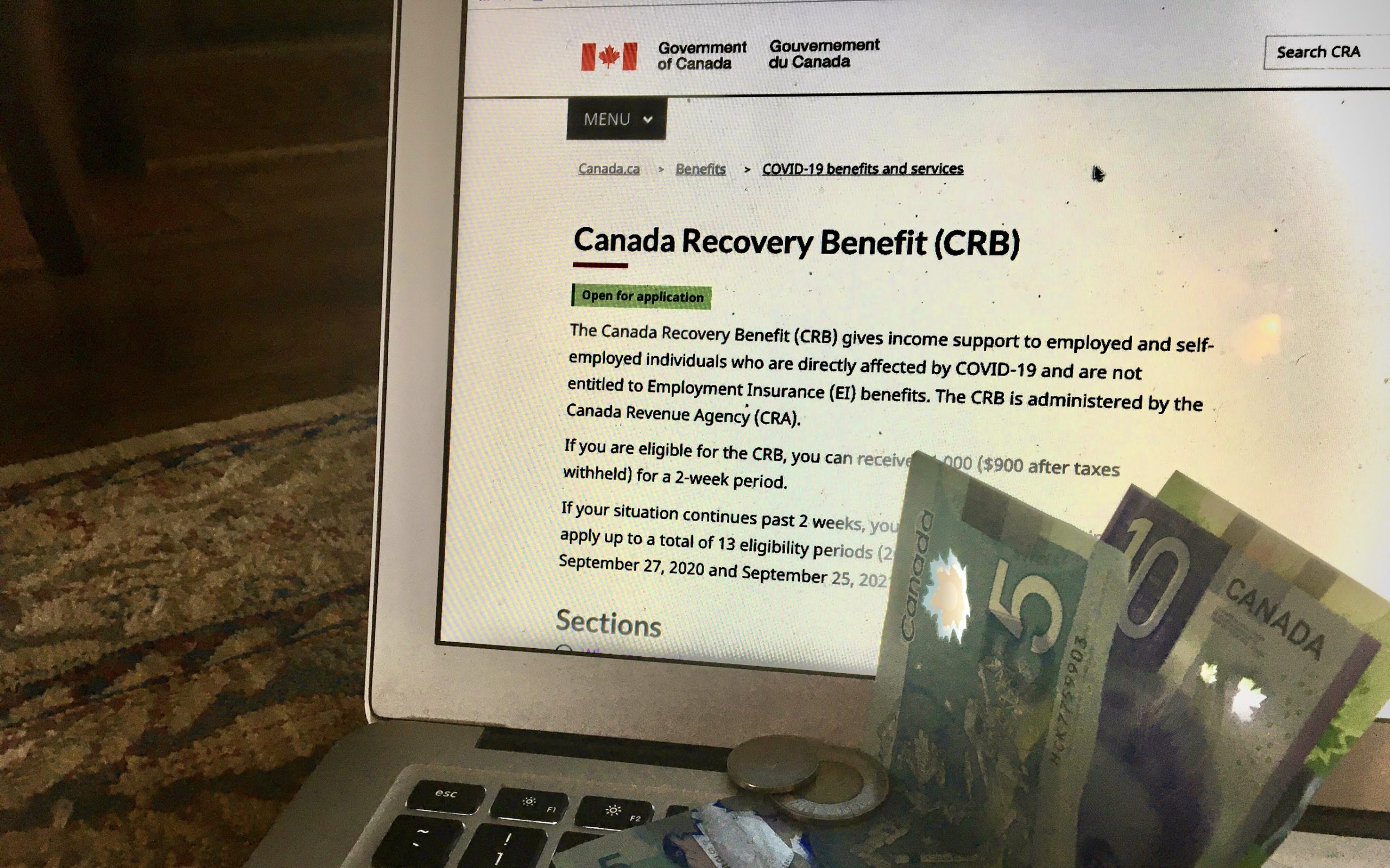

Following the closure to the Canadian Emergency Response Benefit (CERB) and the Canadian Emergency Student Benefit (CESB), the Canada Revenue Agency (CRA) has opened three new transitional relief benefits for those who do not qualify for Employment Insurance (EI); one of which being the Canadian Recovery Benefit (CRB).

Technical difficulties on the first day of applications, October 12, left many unable to access and continue their transition from the CERB and CESB grants until the glitch was fixed.

The CRB’s purpose is to support those who qualified for the CERB or the CESB, but do not qualify for EI.

Charles Drouin, media relations representative for the CRA says the CRB is set to help those who have been impacted by COVID-19.

“The CRB will provide eligible applicants with $500 per week (taxable, tax deducted at source) for up to 26 weeks for those who are not employed or self-employed due to COVID-19, and who are not eligible for EI, or had their employment/self-employment income reduced by at least 50 per cent due to COVID-19. This benefit will be paid in two-week periods and applications made on a retroactive basis.”

There are certain criteria to qualify for the CRB, all of which can be found on the Government of Canada’s website. A few of these qualifications include: being over 15 years old, having a valid Social Insurance Number (SIN), not being employed during the COVID-19 pandemic, and not turning down work for the period in which you are applying for.

“As many individuals are still being impacted by COVID-19 and require temporary income support,” Drouin adds, “the Government of Canada launched three new benefits, delivered by the CRA: the Canada Recovery Benefit (CRB), the Canada Recovery Sickness Benefit (CRSB), and the Canada Recovery Caregiving Benefit (CRCB).” Each of these benefits have their own list of specific qualifications, which can be found on the CRA’s website.

“Faced with the countdown of a grace period to repay upon graduation or ending their studies, this time frame does not account for the pandemic and how much harder it is to find reliable jobs. This is also not factoring in that some are worried for their health…”

While the CRA’s information on how the CRB will affect specifically students is limited, Riaz Nandan, vice-president of operations for the York Federation of Students (YFS) and fifth-year kinesiology & health sciences student, addresses the financial concerns of York students in relation to the CRA’s available services.

“While the CRB is helpful for all Canadians who are faced with unemployment and financial crisis during these times, it is not enough for lower-income students when considering the high costs associated with student life,” Nandan says. “Students are struggling to make ends meet, and should not be met with rising fees.”

Additionally, the student loan grace period came to an end on September 30, 2020, which had frozen students’ loans and interest during the COVID-19 pandemic. With the end of this grace period, which sees students resuming the payment of their schooling debt, Nandan ensures that worries over student loans and financial halts during this time are valid.

“Faced with the countdown of a grace period to repay upon graduation or ending their studies, this time frame does not account for the pandemic and how much harder it is to find reliable jobs. This is also not factoring in that some are worried for their health when being pushed to re-enter the job market while we are still battling a pandemic,” Nandan says.

“Students deserve more leniency and understanding when faced with these high-interest student loans, pandemic or not, and we believe that student debt should be forgiven,” he adds.

For students struggling with loan payments, the CRA offers the Repayment Assistance Plan to aid students who are financially struggling with the resumption of their loans.